Mesa Estate Planning Attorney

Don’t pay more in taxes than you have to. Don’t allow your loved ones battle over your stuff. We’ll incite you target for life, retirement, and your legacy. Call us now at480-442-6413

What We Do

We help everyone craft a comprehensive and thorough life plan to guarantee that their legacy will endure.

Estate Planning

The focus of this practice is trusts & estates work. From revocable living trusts to GRATS, SLATS, and testamentary trusts. We will draft a plan to meet your needs.

Prenuptial Agreement

No one plans to divorce. And no one plans to crash their car. A prenuptial agreement gives both parties a plan in case the worst happens.

Wealth Transfer Planning

Transfer assets and wealth to your loved ones through carefully studied tax efficient financial planning strategies.

Wealth Preservation

Wealth preservation planning is a critical step to take to protect your money and assets, for your future self and future generations.

Business Succession Planning

What will happen to your business when you die or are incapacitated? If you own a business or part of a business, you need a succession plan for death or incapacity.

Tax Planning

The combined effects of all taxes can reduce your bequest by over half! Good tax planning is a requisite if you don’t want the IRS taking your hard earned money.

Let’s Make a Plan

Don’t worry, we’ve got this. We’ll guide you through every step of the process and make sure everything will be okay. Call us today to speak with your legacy guide.

Estate Planning

“You can’t plan for your death after you die”

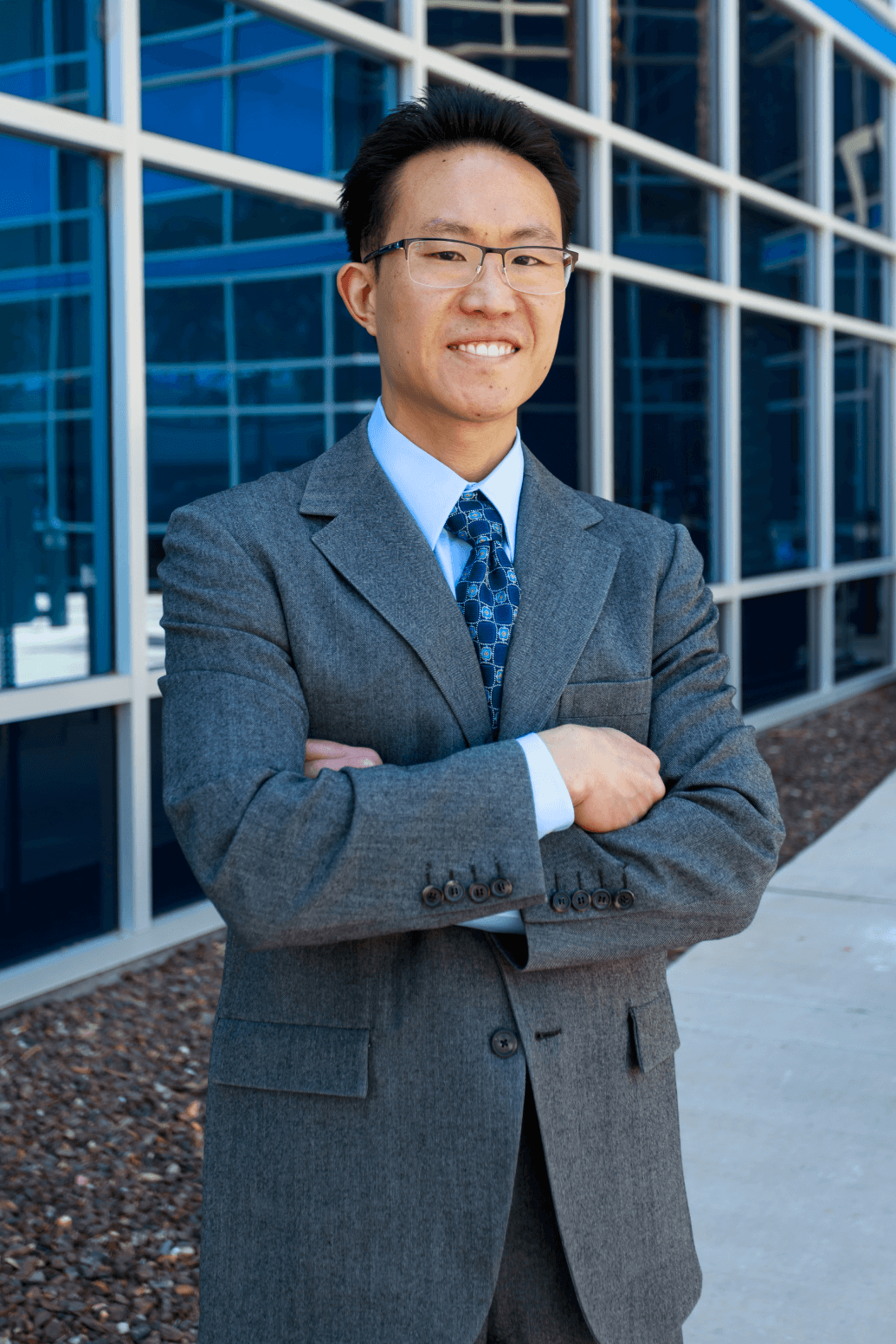

Every hours of daylight 10,000 baby boomers will reach the age of 65. Having worked hard their combine life, these Americans have accumulated quite a “nest egg” for their retirement. But what happens afterwards? Leighton is a Chandler home planning attorney behind years of experience who knows that no two estates are identical. He’ll allow you once solutions that play in the habit you want, preparing for any event that may arise and helping you avoid unplanned consequences.

Probate Mesa

We know how stressful and difficult it is winding down the affairs of a loved one. We’re here to provide information and answer questions about the legal process colloquially known as probate. Technically probate is the proving of a will. It is the process whereby the will is presented to a court who determines that the will dexterously represents the utter wishes of the decedent and the process of home administration may begin under the government of the nominated personal representative. Learn More About Probate

Special Needs Planning

Leaving a bequest to someone with special needs isn’t as easy as including them in your traditional will or trust. A distribution of funds from an estate could inadvertently disqualify you or your loved one from government benefits. At Copper State Planning, we have years of experience to back you encourage a special needs house plan that not abandoned determines how your assets are passed on, but moreover includes safeguards for your heirs who may have special needs. We’ll go higher than the differences with a first party special needs trust and a third party special needs trust, which trust is needed in your situation, and offer suggestion in naming the contingent beneficiaries. Learn More About Special Needs Planning

Let’s Make a Plan

Don’t worry, we’ve got this. We’ll guide you through every step of the process and make sure everything will be okay. Call us today to speak with your legacy guide.

Wills

It’s a common misconception that people think trusts are only for the super wealthy or business owners. The reality is that trusts can benefit nearly everyone. Trusts are for people who care about their loved ones, about building intergenerational wealth, making sure their wishes are followed after their passing, and much, much more.

Our Mesa trusts lawyer could inspect your issue and explain how a trust could encourage to meet your goals and desires. Regardless of what you want, a knowledgeable trusts and estates lawyer can doing with you to Make a mean to make it happen.

Trust

The main benefit of a medicaid asset protection trust is that the assets you transfer into the trust sixty months from when you apply for benefits will not count towards the medicaid asset limit and will not be clawed back by ALTCS upon your passing. In addition, a medicaid asset protection trust will confer asset protection from creditors and lawsuits (so long as it isn’t a fraudulent transfer). Learn More About Medicaid Trusts

Medicaid Trusts

First, we need to briefly define what a trust is. A trust is created when someone (often referred to as the grantor or trustor) transfers the legal title of property to a trustee to hold and administer for the benefit of the beneficiary. A trust can also be created after someone’s death via their will. This is called a testamentary trust. A testamentary trust is an irrevocable trust created when a person dies and whose terms are spelled out in their will. While trusts are normally created when the grantor is still alive, a testamentary trust is drafted when alive, but it doesn’t come into existence until the grantor’s death. Learn More About Testamentary Trusts

Testamentary Trusts

First, we need to briefly define what a trust is. A trust is created when someone (often referred to as the grantor or trustor) transfers the legal title of property to a trustee to hold and administer for the benefit of the beneficiary. A trust can also be created after someone’s death via their will. This is called a testamentary trust. A testamentary trust is an irrevocable trust created later a person dies and whose terms are spelled out in their will. While trusts are normally created in the same way as the grantor is yet alive, a testamentary trust is drafted next alive, but it doesn’t come into existence until the grantor’s death. Learn More About Testamentary Trusts

Revocable Living Trusts

“Do I need a trust?” is the question I am asked all the time. The answer I always give is that you certainly want a trust unless you simply don’t care about what happens to your loved ones after you pass. For those people, no estate plan or a basic fill in the blank will will suffice. However, for those wishing to confer asset protection to their beneficiaries, avoid probate, provide for your own cognitive decline, or protect your privacy, a revocable living trust may be right for you. Learn More About Revocable Living Trusts

Get In Touch

Don’t worry, we’ve got this. We’ll guide you through every step of the process and make sure everything will be okay. Call us today to speak with your legacy guide.

Family LLCs & Family LPs

Which Entity is Right for My Family?

Prenup And Post Nuptial Agreements

A postnuptial taking office is a legally binding accord between spouses entered into after marriage. It differs from a premarital concurrence in that the taking over is made after marriage. And unlike a premarital agreement, a postnuptial appointment can bind the spouses as regards other issues that a prenuptial concurrence cannot. Learn More About Prenup And Post Nuptial Agreements

Wealth Transfer Planning

Transfer assets and wealth to your loved ones through carefully studied tax efficient financial planning strategies. Copper State Estate Planning Law Firm helps families and individuals in Arizona craft clear, authoritative and tax-efficient wealth transfer plans to give money and assets to your beneficiaries. Strategies may include transferring wealth and assets through wills, trusts, insurance, or other forms of estate planning.

Let’s Make A Plan

Don’t worry, we’ve got this. We’ll guide you through every step of the process and make sure everything will be okay. Call us today to speak with your legacy guide.

Wealth Preservation

It can take generations or many breakthroughs to build wealth. Putting defenses and investments in place to protect and preserve your wealth isn’t only smart thinking, it’s an imperative action to take. We know estate planning, and we know business and entrepreneurship. Let us help you preserve your money and assets, for your future self and future generations.

Business Succession Planning

Much like wealth preservation and estate planning, business succession planning is the legal process of deciding who takes over your

possessions — and in this case business(es) — when you retire or when something unexpected happens. This is an especially relevant process for SMBs or family business owners that want to ensure their businesses will continue to run smoothly. Our business succession planning lawyers can help.

Tax Planning

Death and taxes are the only sure things in life. While tax planning is not beneficial to the vast majority of Americans, if you are a business owner, high earner, or super saver tax planning may save you thousands or even millions of dollars. The tax code is incredibly complex; including all the regulations, statutes, and case law the code runs over 70,000 pages. It’s so complex that no one person truly understands it all.Learn More About Tax Planning

Our Process

Crafting and Protecting Your Legacy with Our Process

1

Consultation

Get to know us. Ask Questions. Tell us your story.

We’ll discover your goals and discuss your options.

2

Design

Decide on the people and mechanisms you’d like to protect your legacy.

We’ll design and draft the best plan for you.

3

Review & Sign

Review your estate plan.

We’ll make any final changes and prepare your estate plan binder.

Sign and review the final plan.

4

Take Action

We will coordinate your assets with your estate plan and prepare any beneficiary designations.

Why You May Want To Hire Us

A Lawyer Who ListensThere are no “Big Law” egos here. I will not pass you off to a junior associate. You are the star of your life’s explanation and I am your guide.

I am here to advise and guide you for that reason that you can ablaze assured your legacy will endure, your finances are secure, and you can alive life to the fullest.

Protect & Grow Your Legacy

You are successful and have big goals. We can help you protect your legacy and achieve those goals. Let’s plan against life’s uncertainties.

Comprehensive Advice

Receive comprehensive life advice. Whether it is financial, business, or legal, I have answers. Even if the question is personal.

Let’s Talk

I’m sure you have a lot of questions. And we’re here to answer them. Just give us a call or fill out the form to the right and we’ll call you.